Ethereum Price Prediction: Technical Breakout and Institutional Momentum Signal Potential Rally to $5,000+

#ETH

- Technical Breakout Potential: ETH trading above key moving average with Bollinger Band expansion suggests upward momentum continuation toward $4,676 resistance

- Institutional Demand: Significant whale accumulation and Bitmine's aggressive buying indicate strong institutional confidence in ETH's long-term value

- Supply-Demand Dynamics: Massive ETH outflows creating supply squeeze combined with $638M ETF inflows provide fundamental support for price appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

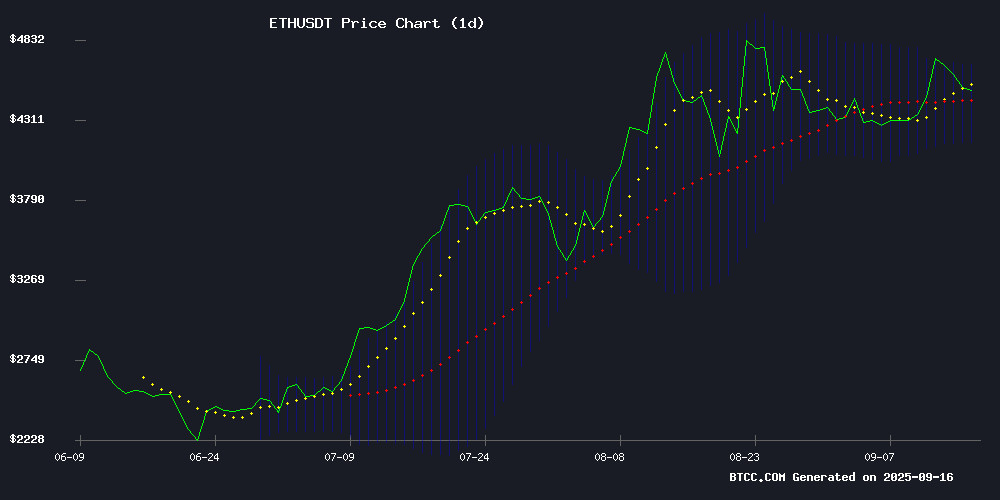

Ethereum is currently trading at $4,528.50, positioned comfortably above its 20-day moving average of $4,418.64, indicating sustained bullish momentum. According to BTCC financial analyst Michael, 'The price holding above the MA suggests underlying strength, though traders should watch the MACD reading of -3.51, which shows some near-term bearish divergence despite the positive histogram reading of 59.86.' The Bollinger Bands show ETH trading in the upper portion of its range with resistance NEAR $4,676 and support at $4,161, suggesting room for upward movement if momentum continues.

Market Sentiment: Institutional Accumulation and Layer-2 Developments Drive Optimism

Recent news flow surrounding ethereum presents a mixed but generally positive outlook. BTCC financial analyst Michael notes, 'The combination of institutional accumulation by entities like Bitmine, massive ETH outflows signaling supply squeeze, and the Ethereum Foundation's new dAI initiative creates a fundamentally strong backdrop. However, the market must navigate September profit-taking risks and the $12B staking exodus, which could create near-term volatility.' The $638M ETF boost and whale accumulation patterns suggest institutional confidence remains high despite Layer-2 growth concerns highlighted by Citi's $4,300 year-end projection.

Factors Influencing ETH's Price

Citi Projects Ethereum at $4,300 by Year-End Amid Layer-2 Growth Concerns

Citigroup has issued a tempered ethereum price forecast, setting a year-end target of $4,300—below current levels near $4,515. The bank's bull and bear scenarios span $6,400 to $2,200, reflecting uncertainty about value accrual from Layer-2 networks.

While Ethereum's network activity remains fundamental, analysts note only 30% of Layer-2 transactions contribute to ETH's valuation. This disconnect makes current prices appear elevated against activity-based models, though tokenization trends and stablecoin demand continue providing support.

The report highlights Ethereum's peculiar ETF dynamics: though flows are smaller than Bitcoin's, each dollar exerts disproportionate price impact. However, limited brand recognition among retail investors may cap this effect.

Ethereum Faces September Profit-Taking Risks Despite $638M ETF Boost

Ethereum (ETH) continues to draw institutional interest as spot ETF inflows surge, with $638 million net inflows recorded between September 8–12, 2025. Fidelity's FETH led the charge with $381 million, marking the fourth consecutive week of gains and pushing cumulative ETF inflows above $13.3 billion.

Despite trading NEAR $4,520 on September 15, historical trends and on-chain signals suggest profit-taking risks loom. Exchange reserves have plummeted to 2016 lows, while over 36 million ETH—30% of supply—is staked, tightening liquidity further.

September's track record as a weak month for crypto adds caution to the bullish narrative. While ETFs signal long-term confidence, mixed market indicators leave ETH's next major move uncertain.

Ethereum Price Prediction: Huge ETH Outflow Signals Incoming Supply Squeeze

Ethereum surged past $4,500, testing resistance at $4,800–$4,880, a critical threshold for its next upward move. Tom Lee of BitMine Immersion (BMNR) highlighted institutional accumulation, stating, "Ethereum is entering a supercycle." Market sentiment aligns with bullish price projections.

Exchange data reveals a sustained supply squeeze. Cryptoquant reports negative netflows since July, with 55K ETH leaving exchanges daily—a trend last observed during bear markets. Recent spikes saw single-day outflows exceeding 400K ETH, signaling intense accumulation.

The shift in investor behavior persists despite earlier volatility. Even after ETH's plunge from $4,000 to $1,500, withdrawals have dominated exchange activity. This unbroken outflow streak suggests mounting pressure for a price breakout.

Bitmine's Aggressive Ethereum Accumulation Signals Institutional Confidence

Ethereum has reclaimed its bullish momentum, surging past the $4,600 threshold as institutional interest intensifies. Bitmine Immersion Technology Inc. has emerged as a dominant buyer, acquiring 276,800 ETH worth approximately $1.3 billion in just two weeks.

The treasury company's relentless accumulation underscores a strategic bet on Ethereum's long-term value proposition. Market volatility appears to have done little to deter Bitmine's conviction in ETH's role as the backbone of decentralized finance and smart contract platforms.

This buying spree coincides with Ethereum's technical breakout toward the $4,700 resistance level. The scale of institutional accumulation suggests sophisticated investors may be positioning for the next phase of blockchain adoption.

Ethereum Foundation Launches dAI Team to Pioneer AI Settlement Layer

The ethereum Foundation has unveiled a specialized AI division—dAI Team—positioning Ethereum as the premier settlement layer for AI agents and the machine economy. Led by research scientist Davide Crapis, the team will collaborate with Protocol and Ecosystem units to enable trustless coordination and payments for autonomous AI systems.

Two core objectives anchor the initiative: fostering an AI Economy on Ethereum through decentralized agent coordination, and preventing centralized AI monopolies by advancing open-source, censorship-resistant infrastructure. Crapis frames this as Ethereum's next frontier, surpassing prior DeFi adoption waves.

The MOVE signals Ethereum's strategic pivot toward AI integration, with the Foundation committing resources to develop on-chain interoperability standards for machine-to-machine transactions. Market observers note parallels to early institutional blockchain adoption patterns.

Ether Whales Accumulate Amid Price Surge, Signaling Potential Breakout

Ethereum's price surge to $4,700 this week has been accompanied by aggressive accumulation from large holders. Fresh blockchain data reveals consecutive eight-figure withdrawals from major exchanges, suggesting institutional-grade positioning ahead of key technical levels.

One unidentified entity moved 5,297 ETH ($24.7M) from Binance and Bitget this week, following a separate $61.65M transfer from FalconX on September 15. The buying spree coincides with Ethereum testing resistance at $4,800-$4,880 - a zone that's repeatedly capped rallies since 2021.

Market technicians note that a daily close above $4,880 WOULD confirm the first major breakout in three years, potentially triggering algorithmic buying programs. The whale activity mirrors patterns seen before Ethereum's 2020 DeFi summer rally, when large accumulations preceded 300% quarterly gains.

Ethereum Staking Exodus Hits $12B as Validators Rotate Capital

Ethereum's proof-of-stake network is experiencing its most significant staking withdrawal since the Merge, with 150,000 ETH exiting validator contracts this week. The exit queue ballooned to 2.63 million ETH ($12.3 billion) - a 327% weekly surge - creating a 45-day backlog for unstaking requests.

Market analysts attribute the movement to yield-seeking behavior rather than bearish sentiment. With staking APR compressing to 2.84%, institutional validators like Kiln are reallocating toward higher-yielding DeFi opportunities. The SwissBorg hack further accelerated withdrawals, triggering a 1.6 million ETH redemption from Kiln's staking pools.

Validator dynamics show a clear net-exit trend: while 597,000 ETH waits to enter staking, the outflow queue now outweighs incoming deposits by 4:1. This capital rotation suggests maturing market behavior as Ethereum's ecosystem diversifies beyond basic staking rewards.

Is ETH’s Real Bull Run Starting Now? This Key Close Could Trigger It.

Ethereum trades above $4,500, eyeing a breakout toward $4,880—a critical resistance level that could ignite the next bullish phase. The asset's 5% weekly gain underscores growing momentum, despite a minor 2% daily dip.

Historical patterns suggest ETH is replicating its 2018 ascending trajectory, with recent rebounds from long-term trendlines signaling potential for sustained upside. Over 2.6 million ETH awaiting unstaking reflects heightened network activity and conviction among long-term holders.

Analysts highlight $4,880 as a make-or-break threshold. A decisive close above this level may confirm the bull run, mirroring past cycles where the price faced stiff resistance at this zone.

How High Will ETH Price Go?

Based on current technical indicators and market fundamentals, ETH appears poised for further upside movement. The combination of strong institutional accumulation, supply constraints from massive outflows, and positive ETF flows creates a favorable environment. Technical analysis suggests initial resistance around $4,676 (Bollinger Upper Band), with potential for a move toward $5,000 if bullish momentum sustains. However, traders should monitor the MACD for any bearish crossover and consider September's historical profit-taking pressures.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $4,528.50 | Bullish (Above MA) |

| 20-Day MA | $4,418.64 | Support Level |

| Bollinger Upper | $4,676.31 | Near-term Resistance |

| MACD | -3.51 | Watch for Crossover |